CAGAYAN de Oro City 2nd District Rep. Rufus Rodriguez today expressed elation over what he described as growing support in the business community for the renewal of Meralco’s franchise.

“We are heartened by the letters of endorsement sent by the semiconductor and electronics sector and private electric power operators for the renewal of Meralco’s distribution privilege by another 25 years,” he said.

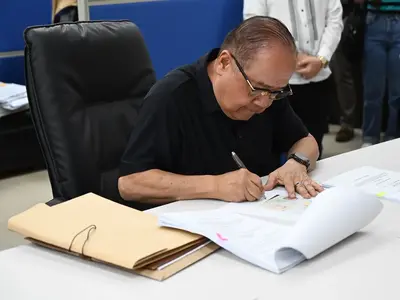

Rodriguez, one of the proponents of Meralco’s franchise extension, said letters from the Semiconductor and Electronics Industries in the Philippines Foundation, Inc. (SEIPI) and Private Electric Power Operators Association (PEPOA) are the latest “encouraging communications” received by the House of Representatives committee on legislative franchises from business groups.

Earlier, the committee chaired by Parañaque Rep. Gus Tambunting received similar endorsements from the Makati Business Club and the Management Association of the Philippines.

“These are four of the country’s biggest and most influential business organizations. We should heed their collective voice of support for the renewal of Meralco’s franchise, together with related statements from some consumer groups,” Rodriguez said.

He called on the franchises committee to report out for plenary consideration a consolidated Meralco franchise renewal bill shortly after Congress reconvenes on July 22.

“We have to tackle the bill as soon as possible to ensure continuous supply of electricity at an affordable price,” he said.

SEIPI’s endorsement was expressed by its president Dan Lachica in a recent letter to Tambunting.

Lachica said, “Amidst the country’s ongoing economic progress, we extend our full support for Meralco’s franchise renewal as they contributed significantly to the industry’s status as the country’s leading exporter. This will give confidence to foreign investors, as it will signal stability in our economic landscape.”

He said Meralco has been a “collaborative partner” to SEIPI and its over 360 member-companies.

He said the power distributor “had been providing excellent service and constantly investing in capital expenditure projects in economic zone locations and industrial parks to meet the robust power quality that is needed by our industry to be globally competitive.”

On the other hand, PEPOA president Ranulfo Ocampo said Meralco’s track record shows that it “has provided reliable electricity that served as the backbone of businesses and enhanced the quality of life for millions of Filipinos.”

He said the franchisee’s “operational excellence and resilience demonstrates its firm resolve to reduce system losses and the duration and frequency of power interruptions that greatly benefitted electricity end-users.”

Meralco has also “shown a strong dedication to social responsibility and universal service by making substantial progress towards the goal of 100-percent household electrification, not to mention its commitment to community welfare programs like the lifeline rate that provide substantial discounts to the poorest customers,” he said.

Ocampo noted that in times of natural disasters, Meralco has helped electricity distributors in the provinces “in swiftly restoring power and maintaining stability in regions hard-hit by typhoons and other natural calamities.”

“Meralco’s invaluable assistance in sharing its resources to typhoon-ravaged regions has alleviated the sufferings of millions of affected customers,” he said.