A BILL aimed at modernizing the Philippine financial system and expanding access to affordable financial services has been filed in the House of Representatives, seeking to give Filipino consumers greater control over their finances and access to banking services while promoting competition and innovation in the banking sector.

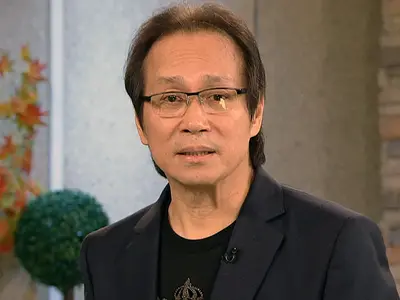

“According to the Bangko Sentral ng Pilipinas, about 44% of Filipino adults remain unbanked despite growth in digital payments and mobile banking,” said Cong. Nathaniel “Atty. Nat” M. Oducado of the 1Tahanan Party-List, author of House Bill No. 6669, or the Open Banking and Open Financing Consumer Data Empowerment Act of 2025. “This is often due to barriers such as distance from bank branches, documentary requirements, and the cost of maintaining accounts.”

The Bill amends the Consumer Act to establish a National Open Banking and Open Finance Framework, which would allow consumers, with informed consent, to securely share their financial data with accredited banks, fintech firms, cooperatives, and other regulated service providers.

“This bill puts the consumer at the center of the financial system,” Cong. Oducado said. “A framework which gives Filipinos ownership of their data would enable them to access better, more affordable, and more inclusive financial products.”

The measure draws from international best practices, citing successful Open Banking and Open Finance regimes in countries such as Australia, the European Union, and the United Kingdom, where consumers have benefited from increased choice and innovation.

“This is expected to help micro-entrepreneurs, low-income households, and communities in geographically isolated areas gain access to credit, savings, and insurance products,” Cong. Oducado stressed. “Enabling responsible data portability will allow financial institutions to develop alternative credit-scoring models, particularly benefiting individuals without formal banking histories.”

It will also address long-standing gaps in the country’s financial system, including strengthening consumer data protection standards, and empowering the Consumer Data Empowerment Commission (CDEC) to set rules, accredit data recipients, and enforce compliance.

Cong. Oducado stressed that the bill complements existing data privacy laws and supports the government’s push for financial inclusion and digital transformation.

“This is not about disrupting the system for disruption’s sake,” he said. “It is about making the financial system work for more Filipinos.”